Angel Scholarship Fund: Be an Angel!

Welcome!

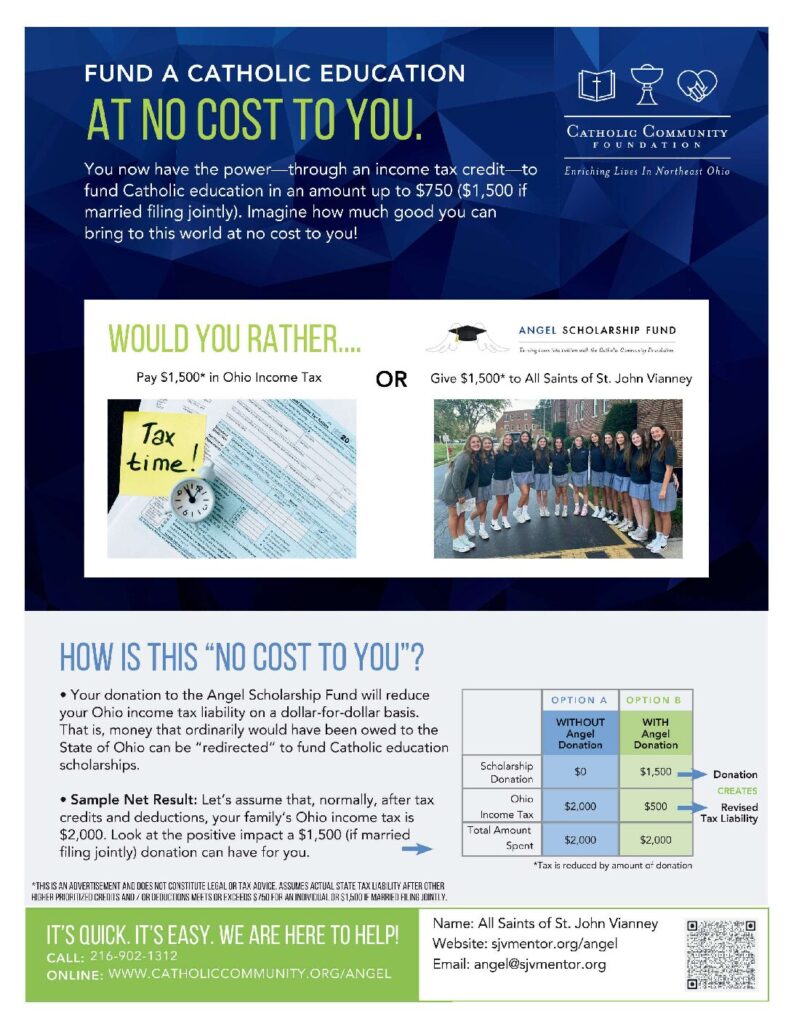

Thank you for taking the time to learn about the Angel Scholarship Fund. I want to encourage Y-O-U to help us raise money for All Saints School with NO COST to donors!

Some people have the mistaken notion that they pay no Ohio income taxes. The confusion is because few of us actually write checks to pay Ohio income tax. Rather, the tax is usually paid by payroll withholding the taxes, which is why people are so unaware of what they actually pay! Retired individuals, likewise, often have Ohio income tax payments withheld from their IRA distributions or investments. So, because of the Angel Scholarship Fund, most SJV parishioners can “redirect” their Ohio tax to directly help Catholic Education.

Give to the Angel Scholarship Fund in Three Easy Steps

Step 1: Review your tax liability from last year (Form 1040 IT, Line 8c)

Step 2. Make an Angel Scholarship Fund donation by December 31 by using this link. Be sure to select All Saints of St. John Vianney in the drop-down menu.

Step 3. Claim the scholarship tax credit on your 2024 Ohio income tax return.

More information is in the flyers below!

If you still have questions, scroll beneath the flyers for our Frequently Asked Questions (FAQs)!

Frequently Asked Questions (FAQs)

The Diocese of Cleveland sponsors the Angel Scholarship Fund, and it has prepared a wealth of explanatory material. If your questions are not answered by the below FAQ, please visit their website.

- What is the Process for Contributing to Angel Scholarship Fund?

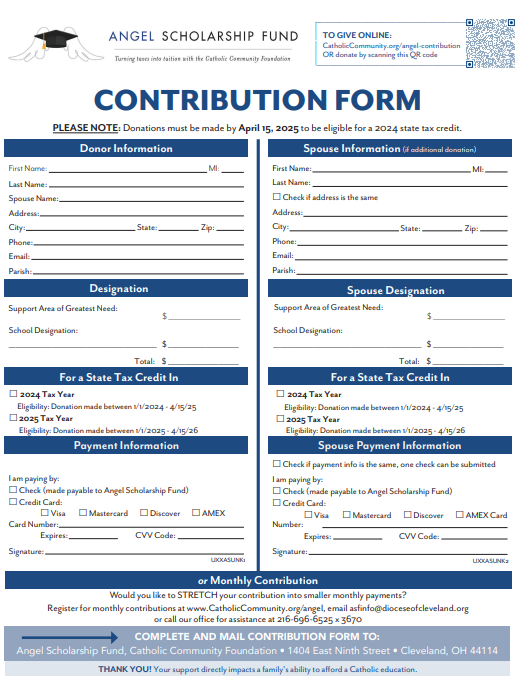

Complete the 2024 Contribution Form (paper or online), select All Saints School as the recipient, and make payment by check, by credit card or use monthly contribution option.

TIP: In order to be eligible for the $1,500 maximum tax credit, BOTH spouses must EACH contribute $750.

- To Whom Must the Contribution Be Made Payable?

It is NOT permissible to make a check payable to your local parish! Rather, checks or credit card payments must be made payable to: “ANGEL SCHOLARSHIP FUND”

- What is the Maximum Tax Benefit? How Much Can I Contribute?

The individual taxpayer limit is $750 (married filing jointly limit is $1,500). So, if your Ohio income tax liability for the entire year will be only $600, then you might want to contribute only $600.

- Why Do Some People MISTAKENLY Believe That They Pay NO Ohio Income Tax?

The short answer is that few of us actually write checks to pay Ohio income tax. Rather, your Ohio income tax is usually paid by payroll withholding … NOT by writing a check … which is why people are so unaware of what they actually pay! Retired individuals, likewise, often have Ohio income tax payments withheld from their IRA distributions or investments. Still, there are some people who also find it necessary to write a check to send in with their Ohio tax return before April 15th.

- What if I Overpay My Ohio Income Tax Liability?

Let’s assume a family has sufficient Ohio income tax withheld from their paychecks or IRA distributions, and then they contribute a total of $1,500 to the Angel Scholarship Fund. For such a family, the entire amount of their overpayment will be returned to them as an OHIO TAX REFUND! None of their money will be lost.

- How Do I Know What My Ohio Tax Liability Will be for 2024?

This is a key question because if your Ohio income tax liability is only $600 and you make an Angel contribution of $750, your tax benefit will be limited to only $600. Here are aids in deciding how much to contribute:

- Many people know that their Ohio income tax liability exceeds the $750 (married $1,500) limit and therefore, they can proceed to contribute $750 ($1,500) to the Angel Scholarship Fund.

- Those that are not sure may choose to look at what they paid in 2024 by reviewing Line 8C of their 2024 Ohio tax return. The amount on Line 8C could be a good estimate of their 2024 Ohio tax liability if their 2024 income hasn’t changed much from 2023.

- The preferred approach is to contact your tax preparer or financial advisor because he/she is in the best position to help you obtain the maximum tax benefit!

- TIP: Please understand that you can wait until after January 1st when all your 2024 tax information is mailed to your home. Then, take all that data to your tax preparer who can calculate your Ohio tax liability and tell you exactly how large a contribution you are eligible to make to the Angel Scholarship Fund. Contributions made before April 15, 2025, do count on your 2024 Ohio tax return.

- What are some helpful Tax Tips?

- You will receive a tax receipt from the Diocesan Catholic Community Foundation that documents the amount of your Angel contribution. That receipt must be submitted with your 2024 Ohio tax return.

- The contribution amount documented on that tax receipt should be placed on Line 15 of the Ohio tax form entitled Ohio Schedule of Credits.

- Some tax preparers may not be familiar with the Angel Scholarship Fund. This website and the SJV bulletin will provide helpful material that you can give to your tax preparer.

- How Can I Get “Reimbursed” for Contributing to the Angel Scholarship Fund?

Since we have described the Angel Scholarship Fund contribution as being AT NO COST to you, it is important that you understand how you will get “reimbursed” for making that contribution.

Here are the different ways Ohio taxpayers get “paid back”:

- The most common way is for a family to receive a REFUND check from the State of Ohio after their tax return has been filed.

- Some taxpayers may choose to obtain a quicker payback by asking their employer’s HR Dept. to reduce the amount of their Ohio tax payroll deduction.

- Retired individuals could likewise request that their custodian reduce the amount of Ohio tax withholding that is withheld from their IRA distribution.

- Those that make quarterly Estimated Payments could choose to reduce or eliminate one or more of those quarterly payments.

- Finally, there are those who wait until tax return time to write a check for what they owe. These people can instead make the check payable to Angel Scholarship Fund for part or all that Ohio tax liability.

- Is there an extended deadline for making contributions?

Yes! Contributions made by April 15, 2025, can be deducted on your 2024 Ohio tax return.

- Can matching contributions from employers be made to the Angel Scholarship Fund?

Yes, this is a great way to multiply the impact of your Angel Scholarship Fund contribution.

Simply mail the matching contribution form with your Angel application or contact the Diocese at (216) 902-1312.

The Angel Scholarship is sponsored by the Catholic Community Foundation. Here is their web page dedicated to the Angel Scholarship!

Did you know you can make your contribution online? Click here to give now!

Find a printable form to fill out here.

Here are some more supplemental documents to help you learn about the Angel Scholarship Fund:

Tax Tips

Info for Tax Preparer